Airline credit cards weren’t always super exciting, especially when compared to other, more flexible card options. Many airline cards only earned one mile per dollar on most purchases and didn’t provide much incentive to stick around beyond the initial bonus. But that’s changed.

While it’s still true that some airline credit cards are simply better than others, there are several that are now quite attractive, including several from United Airlines.

If you fly United at least once or twice a year, you should carefully consider having a family member sign up for a United credit card to make your experience more comfortable and convenient.

With cards ranging from no annual fee to a $525 annual fee, there are plenty of options if you decide to add a United card to your wallet. But no matter which card you decide is best for you, here’s why you might want at least one United credit card in your household.

United Credit Cards Available

| Paper | welcome bonus | annual fee | unique advantages |

|---|---|---|---|

| United Gateway Card℠ | Earn 20,000 bonus miles after you spend $1,000 in purchases in your first three months of account opening. | $0 |

|

| United℠ Explorer Card | Earn 50,000 bonus miles after you spend $3,000 on purchases in your first three months of account opening. | $0 introductory annual fee for the first year, then $95 |

|

| United Quest℠ Card | Earn 60,000 bonus miles and 500 Premier qualifying points after spending $4,000 in purchases in your first three months of account opening. | $250 |

|

| United Club℠ Infinite Card | Earn 80,000 bonus miles after spending $5,000 in purchases in the first three months of account opening. | $525 |

|

| United℠ Business Card | Earn 75,000 bonus miles after you spend $5,000 on purchases in your first three months of account opening. | $0 introductory annual fee for the first year, then $99 |

|

| United Club Business Card | Earn 50,000 bonus miles and 1,000 Premier qualifying points after you spend $5,000 on purchases in your first three months of account opening. | $450 |

|

The information for United Club Business has been independently collected by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

But bonus miles are just the beginning. Here are four more reasons why someone in your family needs a United credit card.

Discounted Award Tickets

Last year we booked a simple award flight from Houston to New York City on United for my mother. United wanted 20,000 miles for the flight when we searched for awards from my mother’s MileagePlus account. On a whim, I checked the availability from my father’s account and it was only 12,500 miles for the exact same flight. The reason?

He had a United Explorer Card, while my mother did not have a United Card.

Those with United elite status, or even just a simple United credit card, have access to cheaper United rewards that non-cardholders simply can’t access. Even in the modern era of United dynamic award pricing, you can save on some rewards by having elite status, and then save again by having a United credit card.

Daily News

Reward your inbox with TPG’s daily newsletter

Join over 700,000 readers for breaking news, in-depth guides, and exclusive offers from TPG experts

In our tests, United cardholders or Elite status holders saved an average of about 2,000 miles per flight.

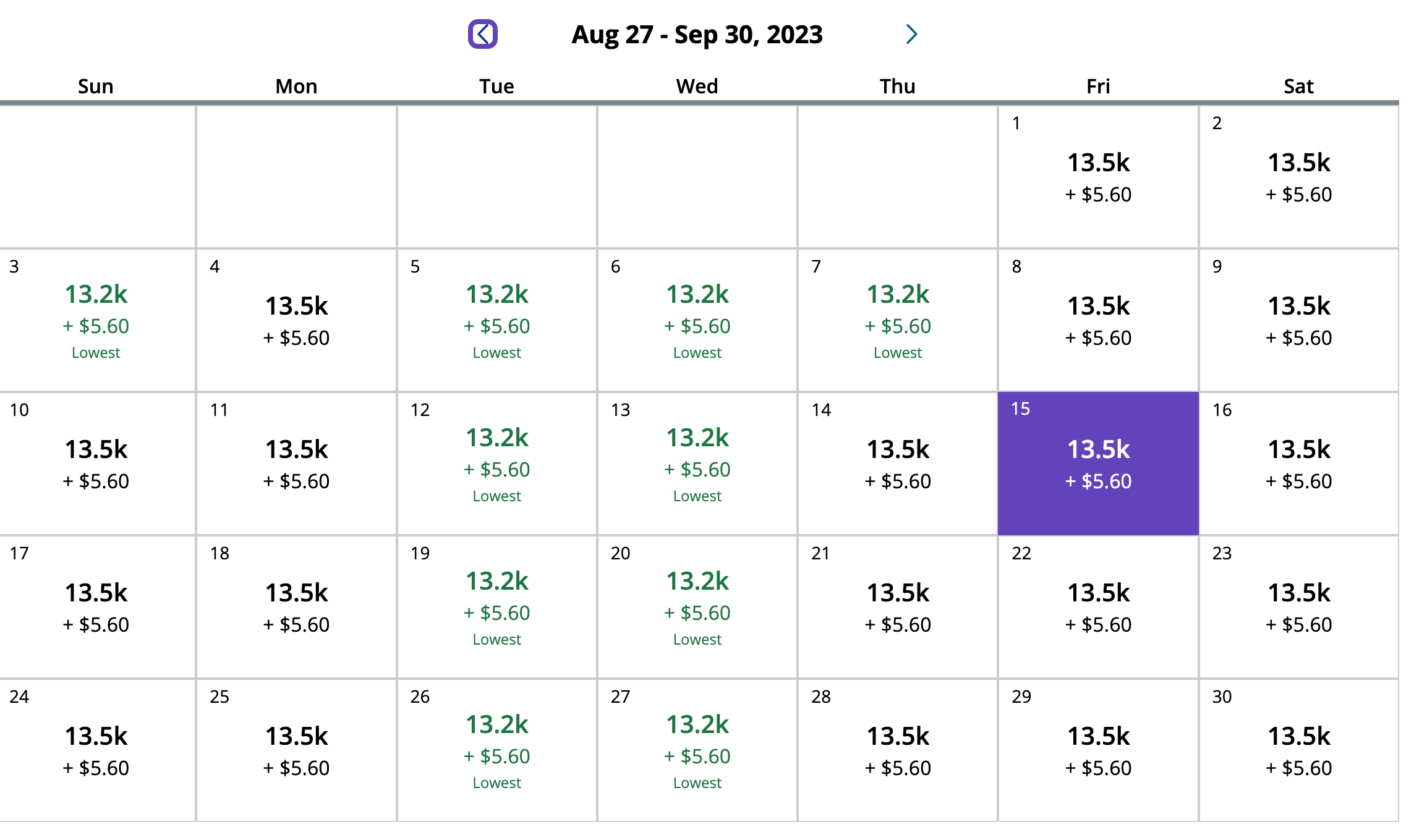

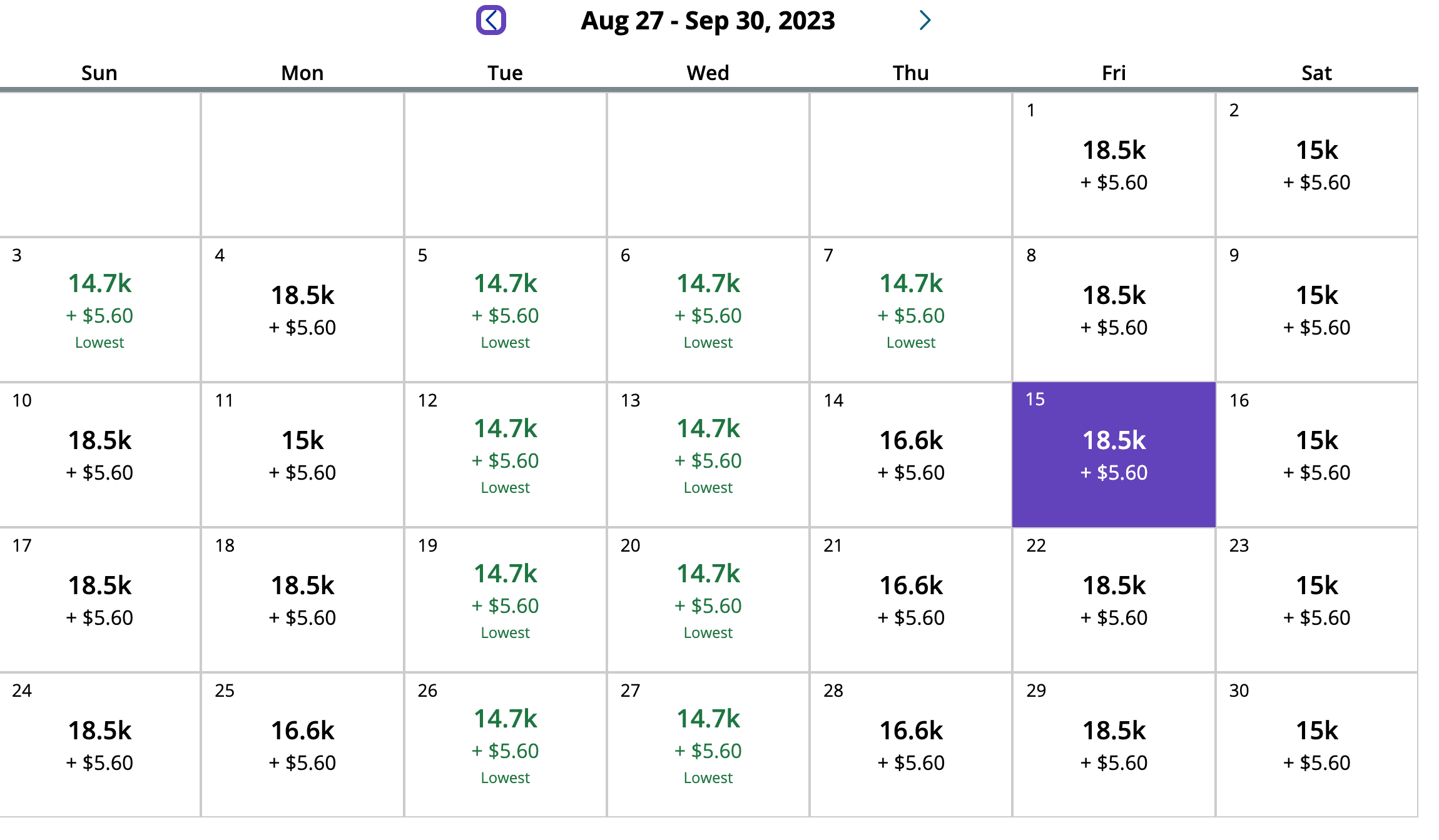

Here’s a recent search from Houston (IAH) to Orange County (SNA). On the date you searched, there were nonstop flights available starting at 13,500 miles each way if you signed in as a United cardholder.

The same flight was quoted at 5,000 miles more one way if you didn’t have a season ticket.

Of course, this is a very small sample, but here’s a look at some of the results from our United award availability tests conducted shortly after the program switched to dynamic pricing. Those results are older at this point, but in our experience, the overall pattern holds even as the exact numbers have evolved.

In our real-world situation, we simply used my dad’s United miles to book the flight and saved 5,000 miles, but if he had only a few miles, one option would have been to transfer points from my mom’s Chase Sapphire Preferred® card to my dad’s United account to book the awards, since he is both a family member and an authorized user.

Related: United Made Big Changes to Achieve Elite Status

Free checked baggage and priority boarding, even in basic economy class

Basic Economy tickets are typically the cheapest available when using cash, but they are also the most restrictive tickets. Fortunately, many United credit cards can make your Basic Economy experience much less restrictive if you are on a United-operated flight with your United MileagePlus number on the reservation. AND you used your United credit card to pay for the ticket.

If you use your United credit card to purchase a Basic Economy ticket, you’ll still receive:

- One carry-on bag for you and each of your travel companions traveling on the same reservation. Those without a United card or elite status will only receive one included personal item, such as a purse or backpack.

- Priority boarding in Group 2 for you and your travel companions traveling on the same reservation. Otherwise, you would be in the last group to board.

- When you book tickets on United cards that typically offer this benefit, the first checked bag is free for you and one traveling companion traveling on the same reservation.

These elements make United’s Basic Economy a little less basic and a little more tolerable.

Save on United

If you spend money on a United flight, a United credit card is a must. All offer 25% back as a statement credit for in-flight food, beverage, and Wi-Fi purchases on United flights. Wi-Fi on most flights is $8 for MileagePlus members (and $10 for non-members), but if you have an eligible United credit card, it’s only $6 out of pocket, since 25% is returned as a statement credit.

If multiple family members need connectivity during the flight or to purchase snacks or drinks on board, then it stands to reason that the benefits of having a United credit card multiply.

Related: Complete Guide to United WiFi

Additionally, with the United Business Card, you can earn a $100 United travel credit after purchasing seven flights per year of card membership (flights must have a value of $100 or more). The United Quest card offers an annual $125 credit on United flights.

Make your journey more comfortable

The first two or three reasons are more than enough to make the United credit card a must-have for anyone flying with this airline, but these cards offer other options as well.

For each account anniversary with the United Explorer Card or United Business Card, you’ll receive two one-time passes to the United Club, which can be a great way to grab a light meal and a drink before a United flight without opening your wallet. Remember, there are even taco bars in some clubs.

Related: Inside the World’s Best United Clubs

The cards also cover the Global Entry/TSA PreCheck application fee once every four years. This may seem a little trivial, as it is a perk offered by many travel credit cards, but families may have multiple people who need to pay these fees, so it is likely that a family can use this perk.

Related: Save $400 on Global Entry Renewals with Credit Cards

Of course, if you have a United Infinite Card or the United Business Club Card, you and two guests, or your immediate family, will have access to the United Club network when flying on United or Star Alliance partners.

In conclusion

At a minimum, one person in a family that flies United even a couple of times a year should have a United credit card. You’ll save miles on award tickets, you’ll save money on flights and checked bags, and you may even be able to join United Clubs to relax before or between flights.

And if you’re wondering if it’s worth having more than one United card, my family currently has three, as they all have different perks. But first things first, if you don’t have at least one United card in your family’s wallet, now is a good time to rectify that with the increased welcome bonuses available.

Related: Current United Credit Card Offers