Editor’s Note: This is a recurring post, regularly updated with new information.

At first glance (and to the layman), credit card annual fees can be a bit of sticker shock. However, upon closer inspection, some of the benefits and perks built into specific cards can more than make up for the initial annual investment.

Take The Platinum Card® from American Expressfor example. While it does carry a sky-high annual fee of $695 (see rates and fees), the card also offers more than $1,500 in benefits in the form of numerous travel and lifestyle credits. And that doesn’t even include other great perks that don’t have a specific dollar value, like lounge access and hotel elite status.

Let’s explore one of my favorite perks on two Amex cards: the Uber Cash benefit built into both The Platinum Card® from American Express AND THE American Express® Gold Card.

Here’s how to use your Amex Uber credits for rides and meals.

Overview of Uber Credits with American Express

One of the most direct advantages of both Amex Platinum AND Amex Gold It’s Uber credit that’s automatically deposited into your account each month. But there’s a little nuance to exactly how this perk works, especially if you’re new to one of these cards.

First, for the Platinum card, you’ll receive up to $200 in Uber Cash per year (for use in the U.S.). The credit is broken down into monthly increments of $15 each, plus a $20 bonus in December (for a total of $35 that month).

Meanwhile, the Gold card offers up to $120 in Uber Cash per year (including for use in the U.S.), which comes in the form of a $10 monthly credit. You must have the latest version of the Uber app downloaded, and your eligible American Express Gold card must be a payment method on your Uber account. Enrollment is required for certain benefits.

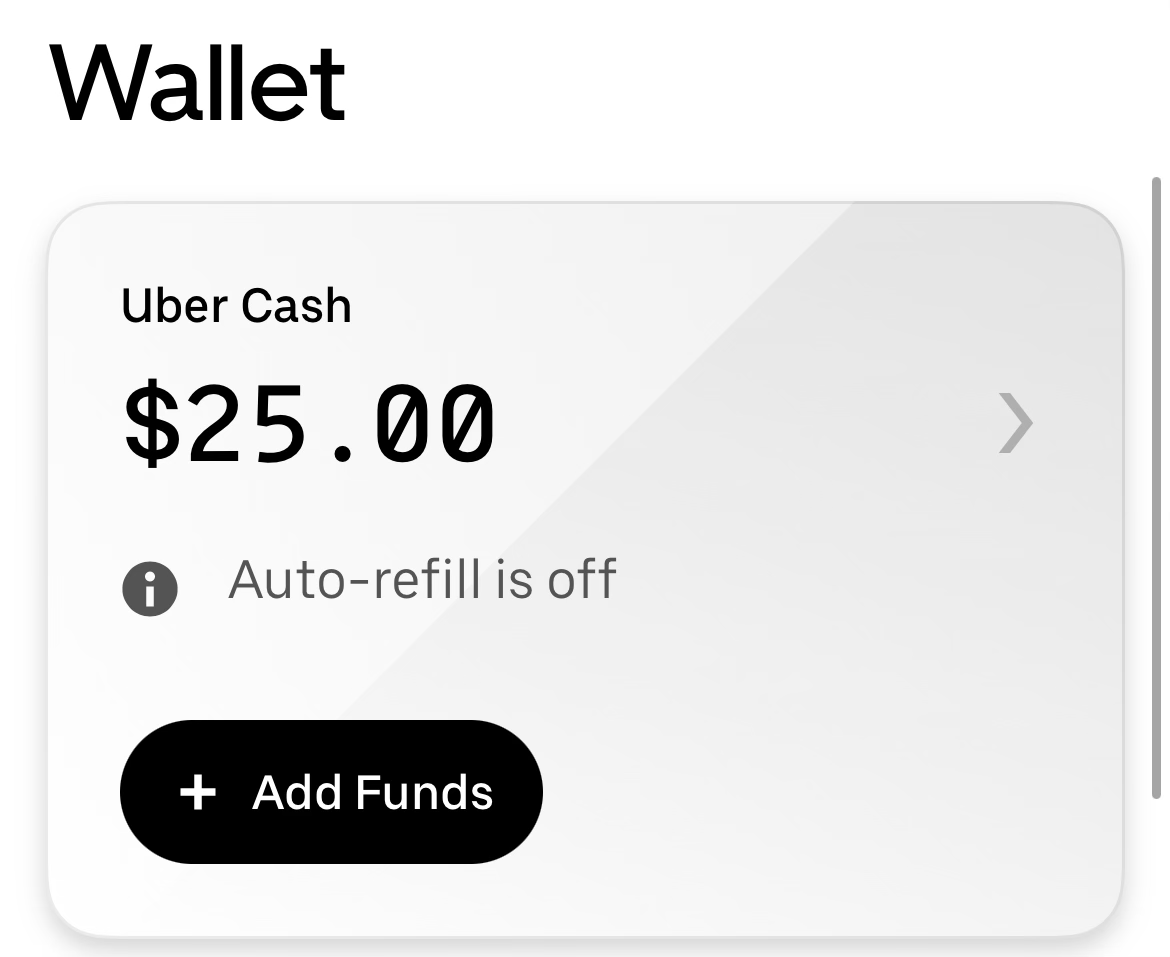

To get your Uber Cash, you will first need to link your card(s) to your Uber account. To do this, go to your wallet in the Uber app and add your Amex Gold and/or Amex Platinum as a payment method. If you have both of these cards (like me), the two monthly credits will be combined into your total Uber Cash balance.

Daily News

Reward your inbox with TPG’s daily newsletter

Join over 700,000 readers for breaking news, in-depth guides, and exclusive offers from TPG experts

From there, the credits should automatically appear in the Uber Cash section of your wallet. As long as your card is linked to your Uber account, your Uber Cash will automatically be deposited into your wallet each month.

Typically, I get a notification that my Uber Cash has been deposited into my account the evening before the first of each month. However, it is important to remember that your credits expire at the end of each month. In other words, if you don’t use your credits one month, they won’t roll over to the next month.

How to use Uber Cash for rides

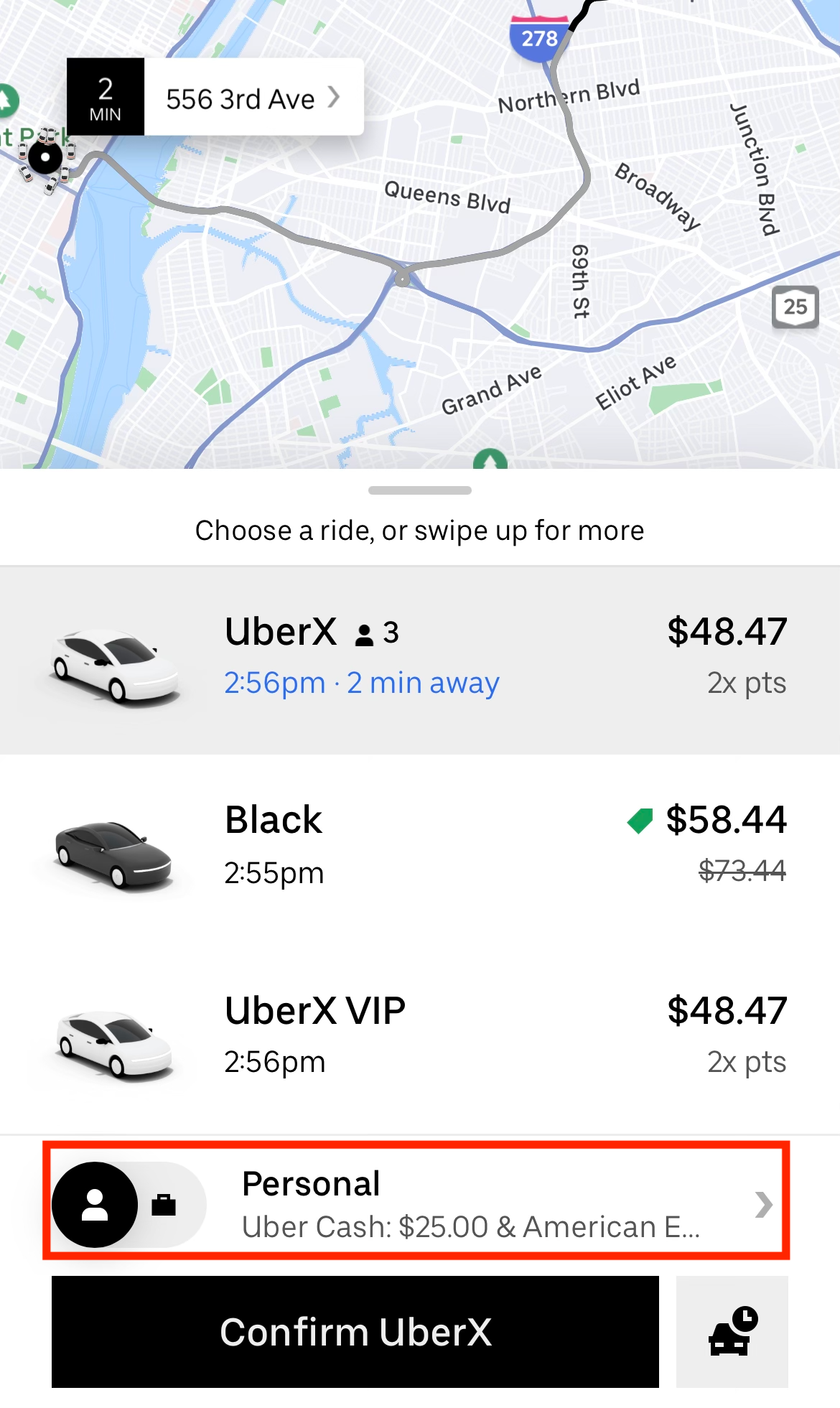

When you’re ready to go, you can find your payment information right before you confirm your ride (you can also change it during the ride).

In the example above, my Uber Cash balance will be depleted and the additional fare will be charged to a card I have on file. Make sure you use a card that earns additional rewards on Uber purchases, such as the Chase Sapphire Reserve® (which earns 3 points per dollar on travel and dining purchases, including Uber rides and Uber Eats).

To ensure you actually redeem your credit, make sure Uber Cash is set as your payment method before requesting a ride.

However, there are some cases where you may not want to use your card’s Uber Cash benefit. For example, if you travel for work, you may not want to use your balance for a ride that your company will cover.

How to Use Uber Cash to Eat or Buy Groceries

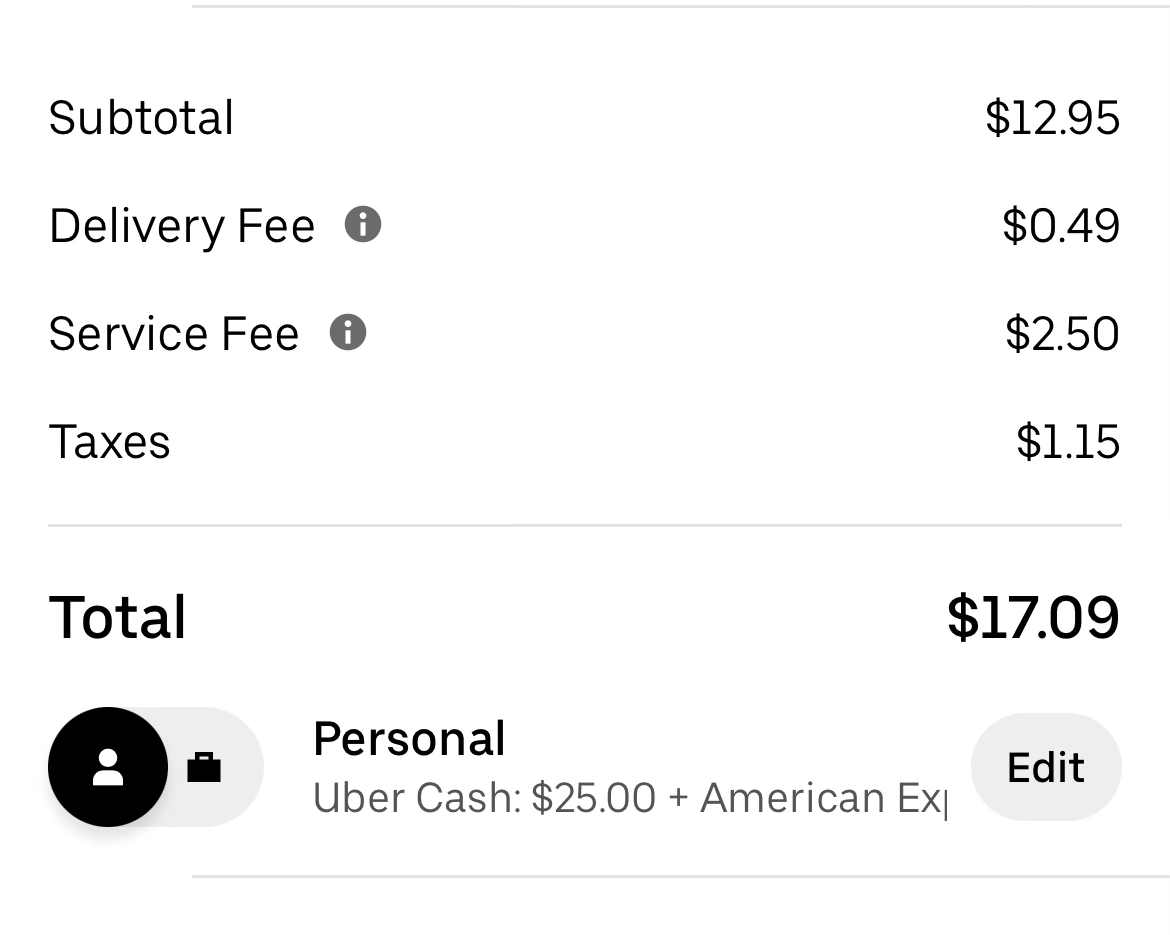

To redeem your Uber Cash for Uber Eats or Uber Grocery, the process will work similarly to when you request a ride. After you decide on your food, you’ll see your payment method right before confirming your order.

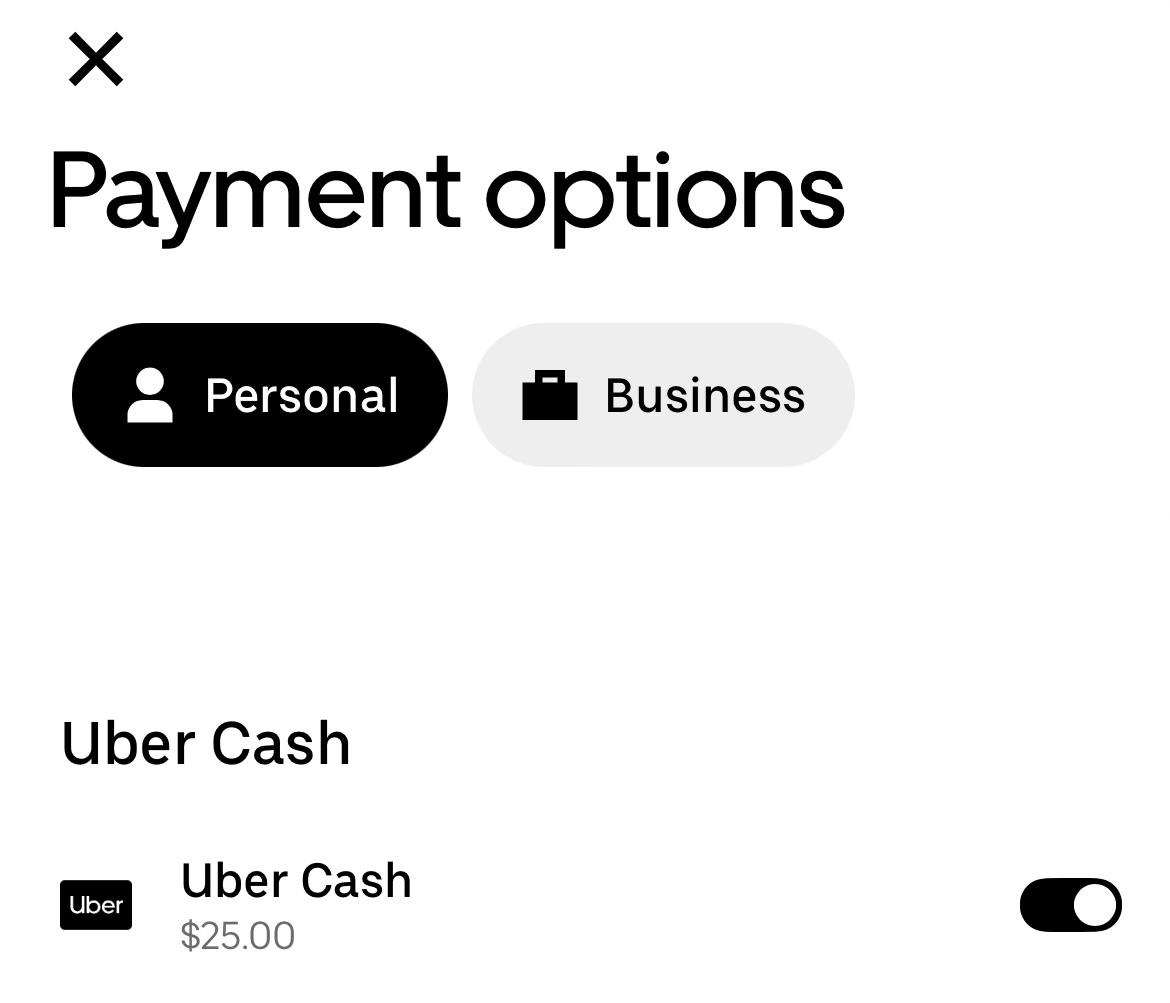

Again, if you actually want to use this balance, you will need to confirm that Uber Cash is activated in your wallet.

However, again, if you are trying to charge a meal to your employer, for example, you may not want to use Uber Cash. In this case, make sure Uber Cash is turned off and that you are using a credit card on file.

Related: How to Maximize Your Benefits with the Amex Platinum Card

In conclusion

Uber credit on both Amex Platinum and Amex Gold is one of the easiest for many cardholders to use, as it can be applied to Uber rides and Uber Eats orders in the US. However, keep in mind that these are “use it or lose it” benefits, meaning the credits will not roll over to the next month. The good news is that there are many use cases, including trips or Uber Eats orders, so you can easily get the most out of this benefit.

For more information, read our full reviews of the Amex Gold and Platinum cards.

Apply here: Amex Gold

Apply here: Amex Platinum

To learn about Amex Platinum rates and fees, click here.