When I found out the annual fee for my Delta SkyMiles® Reserve American Express Card had increased by a good $100 (from $550 to $650; see rates and fees), I was faced with a tough decision: Was this premium travel card still worth keeping?

New cardholders can earn 60,000 bonus miles after spending $5,000 on eligible purchases in the first six months of card enrollment. TPG’s August 2024 valuations peg that bonus at $690.

I decided to keep my Delta Amex Reserve this year to test out the value of its new perks. While I’m still trying to figure out how to best take advantage of each perk, the monthly Resy perk (an online restaurant reservation service) was surprisingly easy to earn. So easy, in fact, that I recently earned the statement credit without even realizing it.

Here’s how to do it.

Related: Have a Delta Amex Card? Here Are 9 Things You Need to Do

Cards that give Resy credits on the statement

It’s not often that a card makes it so easy to use its perks, but that’s exactly what happened to me last month. Before I explain exactly how it happened, let’s take a look at the list of account credits for other cards that earn Resy credit.

The entire lineup of co-branded Delta and Amex cards received annual fee increases and modified benefits earlier this year, as well as American Express® Gold CardI will only focus on cards with the same credits as my Delta Reserve Amex.

Here’s a closer look at the credits in the annual and monthly statement:

- Delta Stays (Delta’s hotel travel portal) for prepaid hotels and vacation rentals

- Resy for eligible purchases at Resy restaurants in the United States*

- Select ride-hailing services in the US like Uber, Lyft, Revel, Curb, and Alto*

Daily News

Reward your inbox with TPG’s daily newsletter

Join over 700,000 readers for breaking news, in-depth guides, and exclusive offers from TPG experts

*Registration required for some benefits; terms and conditions apply.

The amount you can receive for these statement credits varies by card. These are the cards that are eligible to receive all three of these statement credits:

If you have one of these five cards, you can use the statement credits listed to offset your annual fee if you know how to use them. TPG has a must-read guide to help you maximize these credits, so I won’t repeat it here. Instead, let’s get back to my surprise credit.

Earn monthly Resy statement credit

With my Delta Reserve Amex Credit CardI get up to $240 per year (up to $20 per month) in account credits when I dine at an eligible restaurant in the U.S. that participates in the Resy reservation system and pay with my Delta Reserve Amex. You may be wondering how a perk that includes dining at specific restaurants managed to surprise me, but it did.

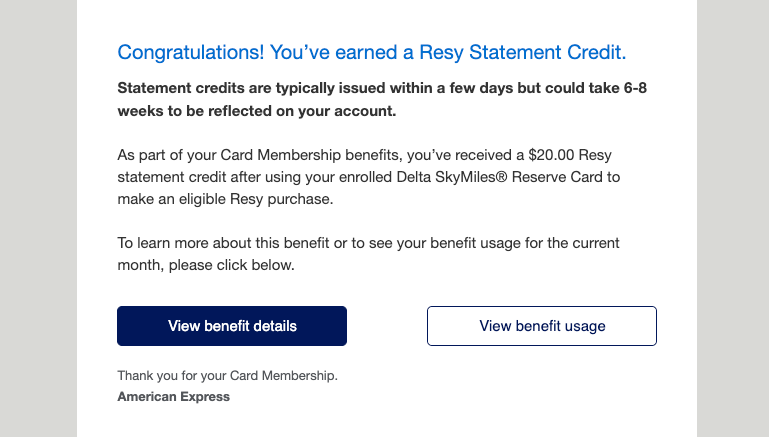

That’s because you don’t have to make a reservation through Resy to earn the credit; you just have to pay your bill using an eligible card. I received an email notifying me that I had earned a $20 Resy credit, even though I didn’t recall dining at a participating restaurant.

My husband was out of town at the time, so the only dinner I had eaten out was going to the McDonald’s drive-thru to get Happy Meals for the kids. As much as my kids love a quick, cheap meal at McDonald’s, I knew that wouldn’t be a good way to get the credit. (McDonald’s does have a great loyalty program, though.)

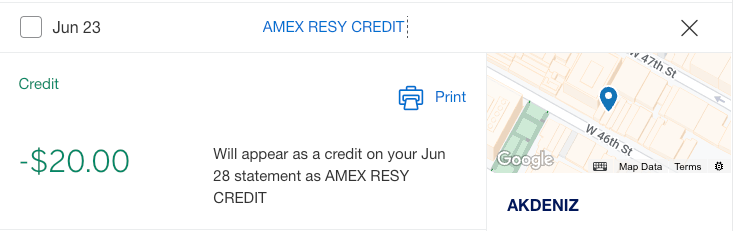

Fortunately, Amex makes it easy to determine the charge that triggered the Resy credit. I logged into my account and found that the restaurant name was listed on the $20 credit transaction. The surprise meal was one my husband had while in New York City. Mystery solved!

New York has a long list of Resy-affiliated restaurants. If you eat in New York or another metropolitan area, you may also receive a surprise statement credit when you use your eligible Amex card to pay for your meal.

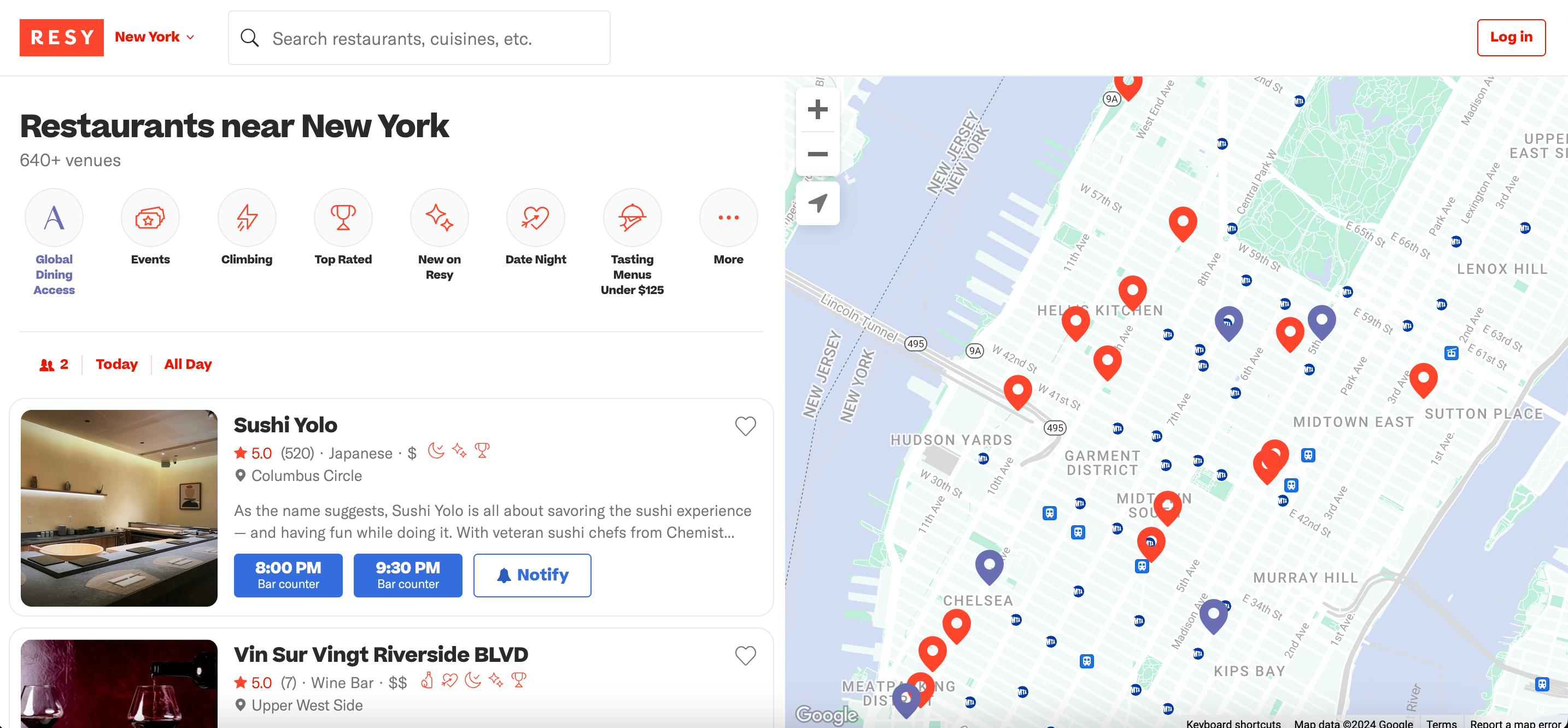

In my hometown, we don’t have many participating restaurants, so I have to plan my monthly Resy credit more carefully. My strategy so far is to review the restaurant list at the beginning of the month as a reminder to stop at one for dinner or drinks at a certain point. Or, if I have a trip coming up, I look at restaurants in my destination and add one to my itinerary.

Finding Resy affiliated restaurants is easy. You can use the Resy website or app to search for nearby restaurants and make a reservation or go directly. Just remember to pay your bill with your eligible Amex card.

Related: Why the Delta SkyMiles Reserve Card Is the Best Card I’ve Added to My Wallet in the Last Year

Other concrete examples

TPG Senior Editorial Director Nick Ewen also has the Delta Reserve Amex Credit Cardand has been able to use the Resy credit in a variety of ways. In March, she received a $20 statement credit at a Restaurant Row restaurant in New York City, and she also used it to offset part of a recent brunch in South Florida with her family.

He even purchased a physical gift card from a local Resy store for a friend’s birthday, triggering a $20 credit to his statement.

Gabe Travers, TPG’s senior director of product management, is usually the one who makes the reservations among his friends, so he has a good mental Rolodex of what’s on Resy and what’s not.

“Between home and travel, we usually eat at a Resy restaurant at least once a month. It takes some practice to remember to pull out my Delta Reserve Amex, since that’s not usually where I put my meal expenses (it’s usually my American Express® Gold Card) — but the new monthly credits help offset Delta Amex’s higher annual fees,” he said.

Like Nick, Gabe has discovered that he can earn monthly statement credit by purchasing restaurant gift cards.

“One of my favorite Resy restaurants that uses Toast as a POS system also sells gift cards on their website that are also processed through Toast,” she said. “In my experience, they seem to trigger the credit on my statement because it’s the same restaurant, same charge, so I can save for an even better night out.”

We’ve seen other anecdotal evidence that purchasing a gift card typically triggers a statement credit, but the outcome can vary depending on how the restaurant charges your card.

In conclusion

Used each month, the Resy statement credit can be worth up to $240 per year. Added to the $120 annual ride-hailing statement credit and the $200 Delta Stays statement credit, that’s $560 per year in savings, which is just $90 less than my Delta Reserve Amex’s $650 annual fee. Membership required for certain benefits.

When you factor in the other benefits of the card, like an annual companion certificate, Delta Sky Club lounge access*, and free checked bags, I can easily squeeze $650 in value out of this card. If you’re thinking about adding a Delta Amex to your wallet, you can get even more value in the first year when you earn the introductory welcome offer.

*Starting February 1, 2025, access will be limited to 15 visits per year.

To learn more, read our full Delta Reserve Amex review.

Apply here: Delta SkyMiles Reserve American Express Card

Related: Is the Amex Delta Reserve Worth the Annual Fee?

To learn about Delta Reserve Amex rates and fees, click here.

To learn about Delta Platinum Amex rates and fees, click here.

To learn about Delta Platinum Business Amex rates and fees, click here.

To learn about Delta Reserve Business Amex rates and fees, click here.