Did you know you can pay the annual fee on your United credit card using your airline miles? It’s called “Pay Yourself Back” — but I’m not talking about using your Chase Ultimate Rewards points with the Chase Pay Yourself Back program.

Alternatively, you can pay your card’s annual fee with regular United Airlines MileagePlus miles.

Don’t feel bad if you didn’t know about this feature or the details surrounding it. The website that hosts this information isn’t widely advertised and doesn’t provide many details.

I’ll walk you through how to pay your United credit card annual fee using United miles.

Cards eligible for this feature

United offers several co-branded credit cards, including the following:

The information for United Club and United Club Business Card has been independently collected by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

*This card is no longer available and is no longer accepting new requests.

All United cards with an annual fee are eligible for this offer, including those that are no longer available to new applicants. This is great news for anyone who is feeling unsure about their card’s annual fee this year.

Daily Newsletter

Reward your inbox with TPG’s daily newsletter

Join over 700,000 readers for breaking news, in-depth guides, and exclusive offers from TPG experts

Related: No Savings, No Problem: How to Unlock Additional Award Availability with United

How to Pay Your Card’s Annual Fee with United Airlines Miles

There is a website that explains this option: choices.unitedmileageplus.com. It mentions that you can use miles to pay your annual fee, but unfortunately, it says you have to call the number on the back of your card to start the process.

Additionally, the terms at the bottom of the page contain some important points you should take into account:

- This feature is only available after you have paid the annual fee within the last 90 days, which means you will have to pay the fee first and then use United miles as reimbursement.

- Redemption values are not published and may change at any time. Currently, the value is 1.5 cents per mile (more details below).

- The statement credit will appear on your account within three business days, and you will see the refund and mileage redemption on your statement within one to two billing cycles.

- Reimbursing your annual fee with miles does not count toward meeting the minimum payment due for that month, so make sure all minimum payments are still met.

There are a few ways to get started. You can call the number on the back of your United credit card as the first method. Just remember to pay that fee first and Then request to use your United points as a refund.

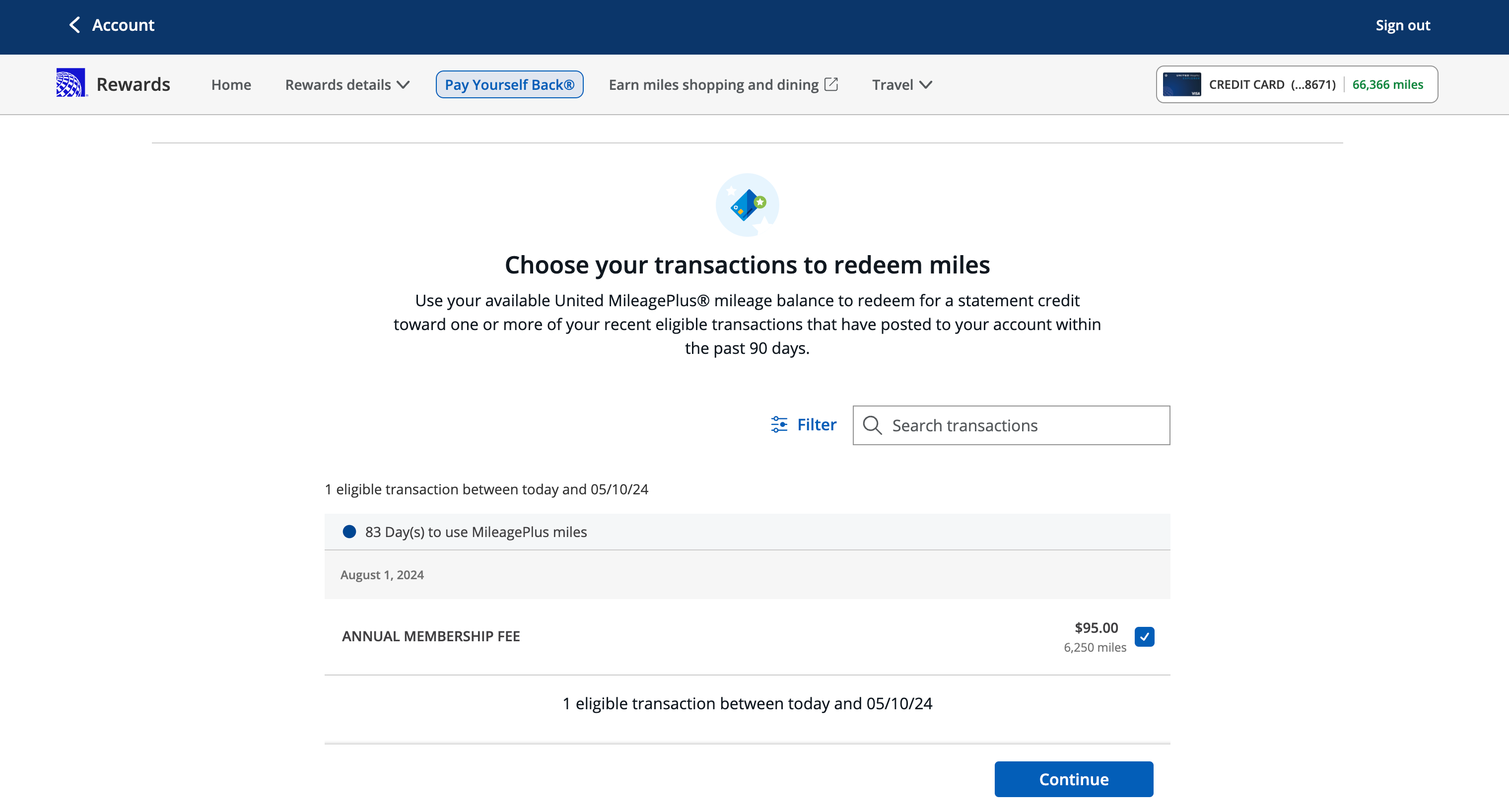

There are two other ways to pay your annual fee with miles. This website describes how to redeem miles for your annual fee online. It is a very simple process, as long as you follow the instructions.

Finally, you can complete this process in the Chase app. Log in to the app and select your United card. Then go to the Rewards & Benefits section and select Pay Yourself Back.

Related: United Premier Status: What It Is & How To Get It

How much does it cost

How much does it cost? Or, to rephrase the question, how many kilometers will you need?

Since you will be paying the annual fee and requesting reimbursement with your miles, let’s take a look at the cost in terms of how many United miles you will ultimately use to reimburse yourself after paying the annual fee on your United credit card.

While the MileagePlus Choices page states, “Redemption values can be changed at any time,” we haven’t seen any changes to the redemption rate in over two years. You can use your United Miles for 1.5 cents each against your card’s annual fee.

Despite this, online forums show that some cardholders have received targeted email offers to use United miles for up to 1.75 cents each toward their card’s annual fee.

TPG’s August 2024 valuations peg United miles at 1.35 cents each. So, this redemption is above the average United mile value. At first glance, this seems like a pretty good deal.

That said, if you regularly redeem miles for first and second place, business-class awards, you’ll likely get more than 1.5 cents each in value for your United miles. In this situation, you may be hesitant to use your miles this way.

Overall, however, this is a good use of United miles when considering all the redemption options, but it’s up to you to decide if it’s right for you.

Here’s roughly how many miles you can expect to pay based on your card’s annual fee (note that these can change at any time):

- United Business Card ($0 introductory annual fee for the first year, then $99): 6,600 miles

- United Club Business Card ($450 annual fee): 30,000 miles

- United Club Card ($450 annual fee): 30,000 miles

- United Club Infinite Card ($525 annual fee): 35,000 miles

- United Explorer Card ($0 introductory annual fee for the first year, then $95): 6,334 miles

- United Quest Card ($250 annual fee): 16,667 miles

Is it worth paying the annual fee for the United Card with United miles?

Whether this process is worth it depends on how many miles it will cost, the types of redemptions you typically make with United, and how many miles you have available. Remember, you must pay your card’s annual fee up front.

If your mileage redemption credit does not appear on time, you should still have funds available to pay your card’s annual fee.

Unless you regularly book first and business class award tickets on United, covering your card’s annual fee with United miles is a great way to use your extra miles. TPG Senior Editorial Director Nick Ewen has the United Explorer Card; he’s considering it since his annual fee just expired on August 1.

“I’ve been disappointed by the recent wave of write-downs from United,” he says. “Our data shows MileagePlus miles are worth 1.35 cents based on our August 2024 valuations, but I often see them lower, even with my cardholder discounts. Using 6,250 miles for my $95 annual fee actually works out to 1.52 cents per mile. Or to put it another way, I’m using 6,250 for a couple of one-time United Club passes, free checked bags, and a Global Entry or TSA PreCheck credit every four years. Not a bad option.”

In conclusion

Using United miles to offset your credit card’s annual fee is an attractive option. Not everyone will benefit, depending on how you like to use your miles, the value you assign to them, or even how many you have in your account right now.

And since there isn’t much information online about this option, you may never have even considered it. That said, I’m a big fan of options, especially when you get a decent value for a ransom.

If you’re interested in using your United miles to pay off your card’s annual fee, call the number on the back of your card or visit the Chase app or website to get started.

To learn more, read our guide to the best United cards.

Related: 6 of Our Favorite, Lesser-Known Benefits of Credit Cards