Data shows that Tether (USDT) and USD Coin (USDC) trading inflows have increased recently. Here’s why this could be relevant for Bitcoin.

Stablecoins are seeing higher-than-usual inflows right now

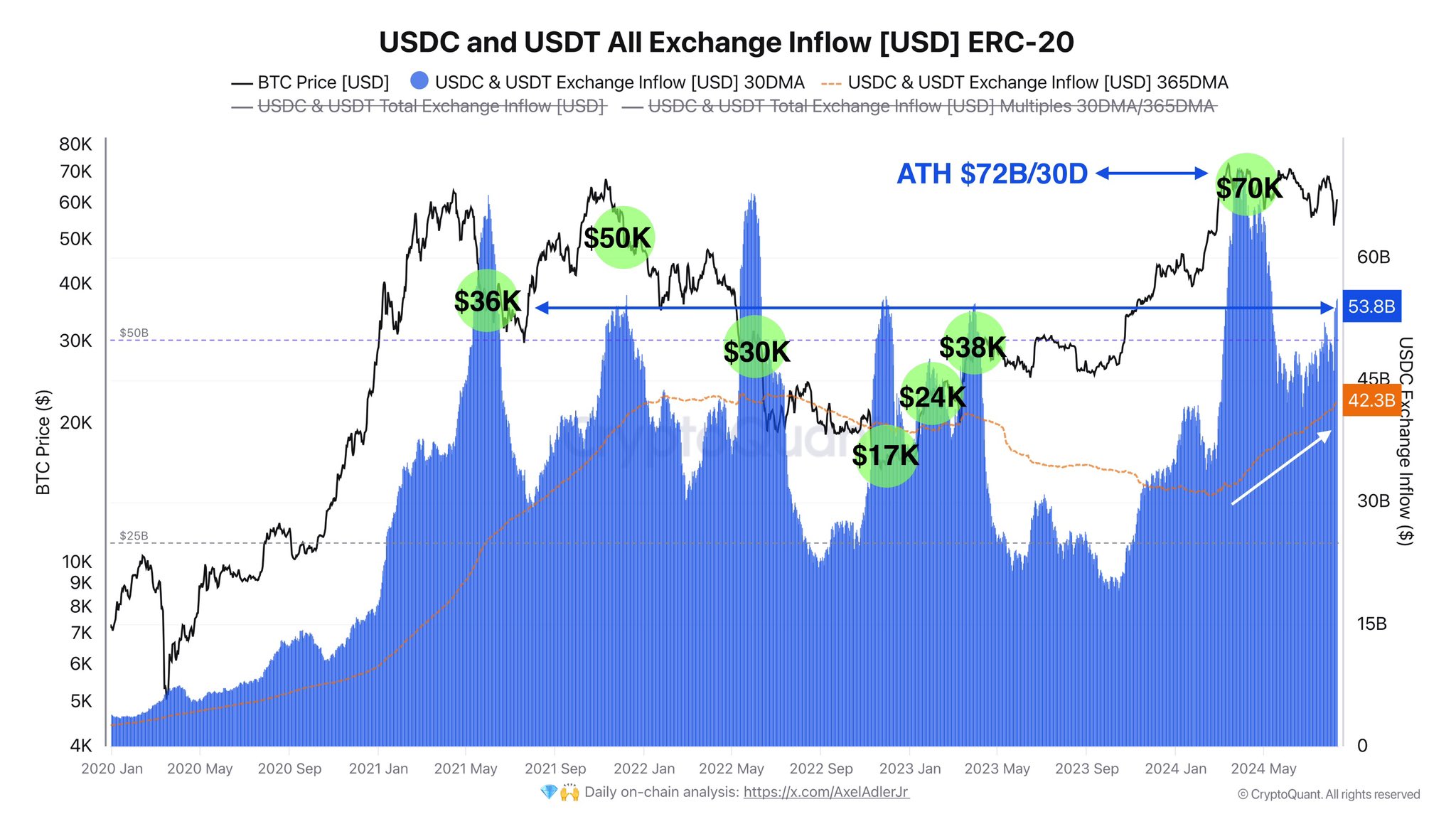

As CryptoQuant author Axel Adler Jr. explains in a new post on X, the average monthly inflows into exchanges of the two major stablecoins, USDT and USDC, have recently increased.

In this case, the term “exchange inflow” refers to an on-chain indicator that tracks the total amount of a given asset deposited in wallets associated with centralized exchanges.

When the value of this metric is high, it means that exchanges are receiving a large amount of deposits at this time. This trend suggests that there is demand among holders to trade cryptocurrency.

On the other hand, the low indicator implies that investors are potentially choosing to hold onto their coins, as they are not making many transfers to exchanges.

What any of these trends mean for the market, however, depends on the type of asset in question. Investors making deposits for volatile assets like Bitcoin can be a bearish signal for the price, as they may be transferring for sale.

In the case of stablecoins like USDT and USDC, while deposits may also mean that investors want to sell these tokens, such a sale would not affect their prices, as they are, by nature, stable in value. That said, they do have relevance to the broader market.

Investors typically store their capital in stablecoins to avoid the volatility of Bitcoin and others. However, investors who store capital this way typically plan to dip their toes back into the volatile side.

Therefore, inflows of USDT and other stablecoins may imply that these waiting investors are ready to invest in BTC and the company. This swap can naturally have a bullish effect on the prices of these volatile tokens.

Here is a chart showing the 30-day and 365-day moving averages (MA) for the combined inflow of USDT and USDC over the past few years:

The value of the metric appears to have been heading up in recent days | Source: @AxelAdlerJr on X

As the chart above shows, inflows into USDT and USDC 30-day exchanges reached quite high levels during Bitcoin’s rally to a new all-time high (ATH), suggesting that there was considerable demand to buy the asset.

During this surge, the indicator set a new record of $72 billion in daily deposits. In the ensuing recession, however, the metric cooled significantly, but has recently started to rise again.

So far, it has hit the $53.8 billion mark per day, which is quite impressive. If these new stablecoin deposits are indeed happening to buy into the volatile side, Bitcoin and others may see a bullish effect.

BTC Price

Bitcoin had previously retraced below $58,000, but the asset appears to have recovered after breaking above the $60,000 level.

Looks like the price of the coin has overall been moving sideways over the last few days | Source: BTCUSD on TradingView

Featured image by Dall-E, CryptoQuant.com, chart by TradingView.com